I’ve been in financial debt in one form or another since I was in high school, which was more than a few decades ago.

I was paying my own way by then. My mother was getting child support as well as charging me rent but nothing was ever enough for her, ever. My sister actually dropped out of high school because she needed to pay rent to our mother. She couldn’t find a job that would pay enough and work around her school hours. She was told to figure it out so her solution was quitting school.

My solution was to barely sleep.

I’d go to school from o’god o’clock till 12:30 when I went to another school for creative writing till 4. Then I’d get to work as soon as I could hustle there, generally 4:30 and work till the kitchen closed, 10 or 11 on weekdays, midnight or 1 on weekends.

I was always broke even with working almost full time. I was paying for rent, food, clothes and anything else I wanted or needed. Living at “home” was cheaper than moving out so I stayed there. A boarding house would have been a lovely solution but I didn’t know any existed at that age.

My friend M was always loaning me $20 or so to get me through to the next check. I almost always had a tab with her. I’d catch up with the next infusion of cash from extra hours over a school break, cash gifts from holidays and general scrounging and hustling.

It was so kind of her to do that. She never judged or nagged. Just this calm acceptance of this is how things were.

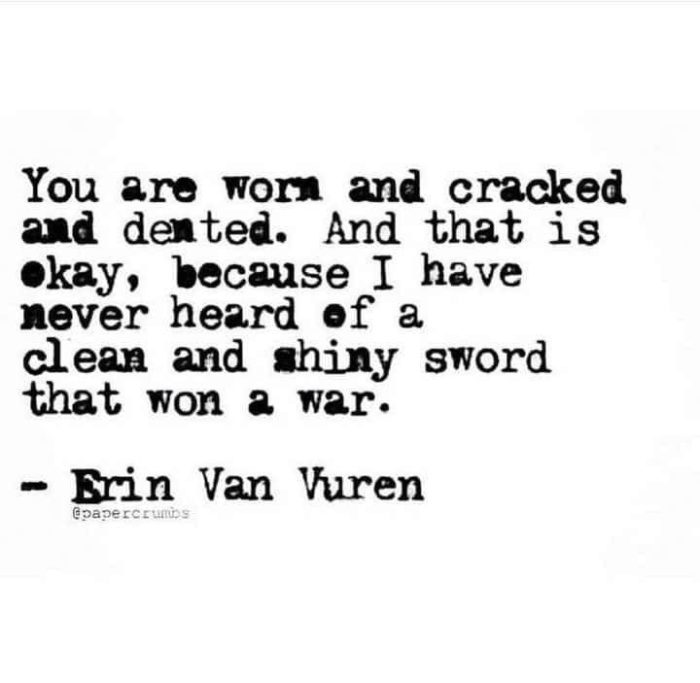

A bit of peace in a sea of chaos.

I was in college when I got my first credit card. It was a Sears card and I used it to pay for my first pc so homework would be easier. The computer lab at school didn’t have hours that synced with mine between classes, work and trying to have a somewhat social life. And they were always crowded with no paper in the printers so their usability was minimal. State schools don’t have the resources that private ones do.

From the store card I went to a general purpose one in quick order because I always paid my bill on time. It might not have been much above the minimum payment but at least it was always on time. I didn’t really understand the wonder and curse of compound interest yet. I’d always lived in a paycheck to paycheck family with a flush of cash on payday and then digging quarters out of the couch for gas, cigarettes or booze by the end of the week. Saving, money management and other financial issues weren’t something discussed around the dinner table. It just didn’t exist for people like us. Doing whatever needed to be done to get through to the next paycheck was just the way the universe functioned.

So I got that credit card and M and I went to the mall. She was home from college for some break or another and borrowed the family car to get out to the shiny and silvery burbs. I bought a burgundy silk shirt with a wide ruffle at the scoop neck and generous sleeves. The fabric felt fantastic, the color was super saturated and it was hideously expensive for me. Probably the most expensive piece of clothing I owned for several years, including shoes.

You know how much it was?

This was the early 1990’s keep in mind.

$50

Shocking, I know. Just gives an idea of where I was on the economic ladder. A ladder I only vaguely understood existed because I knew no one different except for an aunt I saw rarely.

So I bought the shirt, and probably school books and the occasional meal. I always paid my bill on time. It might not have been much above the minimum payment but at least it was on time.

And then came a youngling, marriage and full-on adulting. I was focused on raising her and he was closed-mouthed about numbers. Dangerous combo for my climbing debt load.

Once he left I started whacking at the debt but when the younglings needed shoes and backpacks and winter coats, options were limited. I wasn’t extravagant but they weren’t going to go without when I had this handy plastic option in my wallet. Been there, done that, wasn’t going to push that on to the next generation.

Then came another romantic partner with his own mountain of debt to climb. We differed on how to clear it all out and my mountain grew a bit more, especially once I got sick and couldn’t work as much.

When he left, he took 2/3’s of the household income along with his worldly possessions in trash bags. I kept whacking at my debt.

Being the only adult in the house I could now make all the decisions and most of the sacrifices. But they were my choices to make.

I was tired of carrying this weight, for decades now.

My possibilities were anchored down and limited by it.

I paid off 2 of my 4 cards and was working on the last ones but they were the highest balances. I didn’t see being able to finish them off any time soon.

And then my mother died.

Whoo hoo!

But that’s another story.

I stepped up as executor and was buried, literally, in paperwork. Pandemic lock down and unemployment couldn’t have come at a better time. It was nerve wracking in the moment, but I can’t see how I would have cleaned up her mess without the space it gave me.

I would have figured it out no matter what historic event was taking place but this one worked in my favor, for once.

My siblings and I all figured she’d live for at least another couple of decades and by then there wouldn’t have been anything left besides decades old bill receipts, tchotchkes and dead bugs. So many dead bugs.

Guess we got lucky.

How horrible to say you’re lucky because your mother died before reaching 70 but how very true in this case.

Once I had run down all her accounts and found what money there was my siblings and I were issued checks. I tried to negotiate with my card companies as instructed by a volunteer financial advisor I’d found through my therapist. I would have had to trash my credit score, be in default or bankruptcy and close the accounts in order to get them to reduce the balance. It’s like they know they have you over a barrel or something.

So I paid them.

All of them.

Every one.

It took me a few moments to press “pay now” on the last one. It was the biggest balance overall but was lower than it had been in years. I pressed the virtual button and my blood pressure immediately spiked. My vision went kind of wonky and I had to breathe deep to calm my pounding heart. The youngling came into my study just after I’d done it. She held off her teenage angst rant long enough to ask if I was alright.

Yeah, I am.

It’s done. It’s gone.

Balancing a household budget will still be a challenge because of the nature of my work and capabilities. But at least I’m paying for the tangible things and not the privilege of borrowing a bit of wealth for a moment.

2021 has certainly been an interesting year.

If nothing else, I can look forward to seeing zeros across the statements in 2022.